Share on:

In today's fast-paced business environment, accounting firms are under immense pressure to deliver accurate, timely financial services to their clients while managing a growing volume of documents. Traditional document handling methods are not only time-consuming but also prone to errors.

Tyms Accounting Software leverages AI-powered document automation to revolutionize how accounting firms manage their workflow, significantly reducing the time spent on administrative tasks and enabling firms to acquire more clients.

This blog post explores the benefits of Tyms Accounting Software, detailing how its AI-powered document automation can transform accounting practices, streamline operations, and enhance client satisfaction.

The challenges faced by accounting firms

Accounting firms deal with various challenges related to document management, including:

- High Volume of Documents: Managing large quantities of sales receipts, bank statements, invoices, and other financial documents.

- Time-Consuming Processes: Manual data entry and document sorting are labor-intensive and prone to errors.

- Inconsistent Document Formats: Handling documents in multiple formats (PDF, XLSX, PNG, JPG) can be cumbersome.

- Compliance and Accuracy: Ensuring that all financial data is accurate and complies with regulatory standards.

How Tyms accounting software solves these challenges

Tyms Accounting Software provides a comprehensive solution to these challenges through its AI-powered document automation capabilities.

1. Seamless document intake

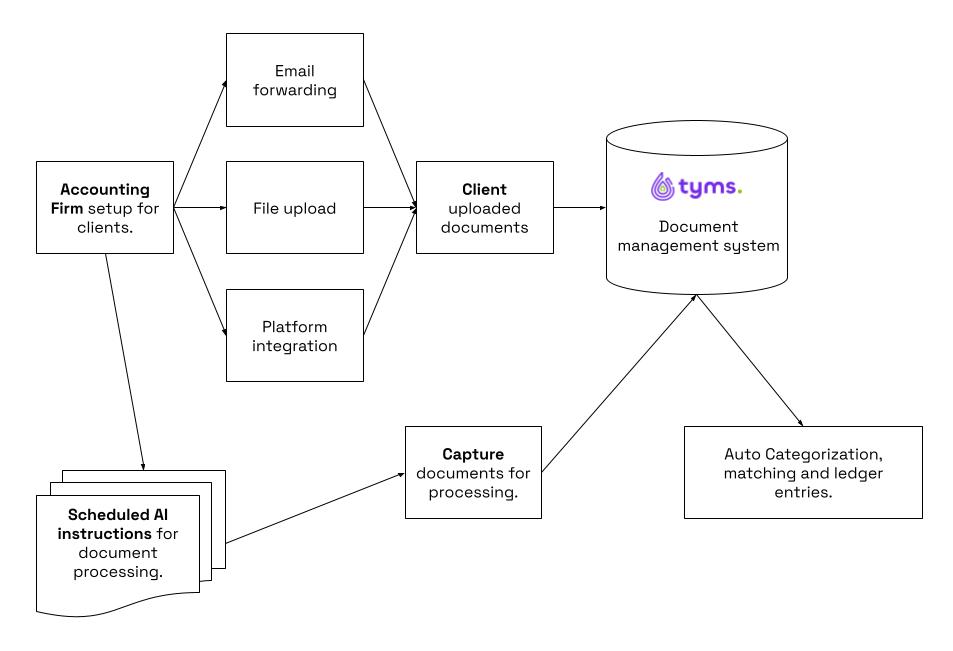

Tyms offers multiple channels for clients to submit documents:

- Shareable Links: Clients can upload documents directly through a secure, shareable link.

- Dedicated Email: Clients can forward documents via email, which are automatically ingested into the Tyms system.

2. Intelligent document classification and extraction

- AI-Driven Classification: Tyms uses advanced AI algorithms to classify documents by type (sales receipts, bank statements, invoices, etc.).

- Accurate Data Extraction: The AI extracts relevant data fields from each document, such as dates, amounts, and vendor names, with high accuracy.

3. Automated workflow scheduling

- Customizable Workflows: Firms can create scheduled workflows with AI instructions to locate specific documents and extract data into the ledger.

- Efficiency and Accuracy: This automation ensures that data is accurately and efficiently processed, reducing the risk of human error.

4. Streamlined financial statement preparation

- Approval Process: Accountants can review and approve AI-processed data, ensuring accuracy before finalizing financial statements.

- Automated Report Generation: Tyms generates financial statements, saving time and ensuring consistency.

5. Enhanced bank reconciliation

- AI-Powered Matching: The software matches transactions in bank statements with corresponding invoices and bills.

- Error Reduction: This automated process minimizes discrepancies and ensures accurate bank reconciliation.

Case example: Accounting firm XYZ approach to 10x profitability and client base with Tyms automation

Let’s see what the journey looks like for accounting firm tagged XYZ setting up an automation workflow on Tyms to manage 20 clients in different industries.

What accounting firm XYZ primarily do for clients

Accounting firm XYZ has the sequence listed below as the primary job done for their clients:

- Collect monthly bank statements.

- Collect monthly sales or point of sales data.

- Collect all supplier invoices and expenses receipts.

- Manage fixed assets register.

- Get all financial statements, management reports and computations needed to file taxes ready.

What accounting firm XYZ primarily do on Tyms

Accounting firm XYZ has the setup below done for each client after carrying out a thorough analysis of the business and how to describe their transactions and:

- Creating a Tyms account for the accounting firm XYZ

- Creating a Tyms account for each client and adding them under accounting firm XYZ Tyms account.

- Under the Tyms automation module, create a folder where you want documents that clients can upload via a sharable link you provide for them. Also, a forwarding email address can be provided for them to share all documents so it is automatically captured inside their account on Tyms.

- Create an automation workflow scheduled to run at a specific time to pick up all the documents uploaded and process it.

- Review all processing done and click a single approve button to have all moved to ledgers with income statement, balance sheet, cash flow statement, trial balance and financial ratios prepared and computed instantly.

- Create the assets register for real-time depreciation and necessary computations that syncs with the ledger.

Tyms is time saving for accounting firms

By automating document processing, Tyms Accounting Software significantly reduces the time spent on administrative tasks. Firms can process documents faster and more accurately, allowing accountants to focus on higher-value tasks such as financial analysis and client consultation.

Tyms boost profitability for accounting firms

With more efficient operations, accounting firms can handle a larger client base without compromising service quality. The ability to manage documents through shareable links and dedicated emails simplifies client interactions, enhancing client satisfaction and retention.

Affordable and Accessible

Tyms Accounting Software is designed to be affordable for accounting firms of all sizes. The cost savings from reduced manual labor and increased efficiency make it a valuable investment. Firms can schedule a demo to learn more about the software's capabilities and get started with AI-powered document automation.

Conclusion

Tyms Accounting Software's AI-powered document automation is a game-changer for accounting firms.

By streamlining document management, reducing errors, and saving time, Tyms enables firms to provide better service to their clients and expand their client base.

With its affordable pricing and user-friendly interface, Tyms is the ideal solution for accounting firms looking to modernize their operations and stay ahead in a competitive market.

Schedule a Demo

Discover how Tyms can transform your accounting practice. Schedule a demo today to see the software in action and learn how it can help your firm save time and acquire more clients.

Visit https://tyms.io/request-demo to schedule a quick demo.

For more information, contact us at contact@tyms.io.

Ibrahim Adepoju

3 mins read

Tyms

2 mins read